Stakes are high for SD-WAN – Airtel invests in Lavelle Networks

Yesterday, Airtel acquired a 25 percent stake in SD-WAN specialist Lavelle Networks. Let us try to make sense of this development and answer a few questions. What does it mean for Airtel? What’s in it for Lavelle Networks? Why SD-WAN?

Lavelle Networks has developed SD-WAN suite based on its indigenous ScaleOn network architecture. The company offers a controller, edge port and gateway to complete its SD-WAN portfolio.

What is SD-WAN?

SD-WAN is a use case of software defined networks (SDN). SDN decouples the network control and forwarding functions enabling the network control to become directly programmable and the underlying infrastructure to be abstracted for applications and network services.

SD-WAN, as the term suggests, refers to the application of the SDN paradigm to WANs. SD-WAN is many a time used interchangeably with bandwidth on demand (BoD). While BoD caters to specific requirements of bandwidth provisioning, SD-WAN deals with the network at a more fundamental, design level. Simply put, SD-WAN pushes network topology deeper into the cloud by pushing the network elements into the virtual space. Consequently, the SD-WAN use-case has a deep association with the virtualized customer premise equipment (vCPE).

What does Lavelle Networks stand to gain from Airtel’s investment?

SD-WAN as a technology has been around since 2013. The SD-WAN solution vendor market is very competitive. The market has seen high-profile acquisitions such as VMware (VeloCloud), Cisco (Meraki and Viptela), Nokia (Nuage), HPE (Silver Peak), Oracle (Talari) and Palo Alto Networks (CloudGenix) among many others. In essence, long-term survival in this market requires deep pockets. Airtel’s investment will certainly help Lavelle Networks on that front.

Airtel’s move is in sync with the trend of an increasing number of Indian telcos continuing to invest in telecom products and solutions. What is in it for Airtel?

The answer to this question can be sought at two levels.

At the first level, look at the SD-WAN technology itself. The technology has been projected as a real alternative to multiprotocol label switching (MPLS), which ranks among the most flexible and contemporary WAN switching and routing technologies. While MPLS maintains a healthy lead over SD-WAN, the latter is projected as a less expensive and more flexible alternative to the former. Being one of the leading providers of MPLS connectivity, Airtel will obviously find value in investing in a meaningfully competing technology. To be sure, Airtel offers SD-WAN solution in collaboration with Cisco. A stake in Lavelle Networks will offer Airtel deeper options to tailor SD-WAN solutions.

At the second level, Lavelle Networks as a company has a customer base exceeding several thousands in India alone, which makes the company an attractive investment target.

Over the past few years, enterprises have become far more demanding of what they expect from their WANs. An added dimension has been introduced by the pandemic, pushing several users in the WFH or hybrid operational modes. SD-WAN can render enterprise networks to be nimble and agile. Watch out for more action in this space in the near future.

|

RELATED BLOGS

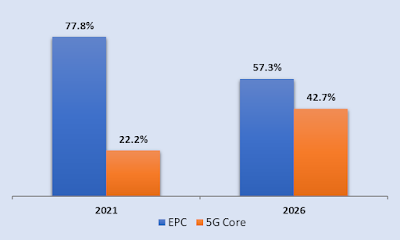

Future of 5G Core – Putting it in Numbers

The Cloud Native Pole Vault – The contrasting fates of Rakuten Mobile and Jio