What Drives AI in Network Optimization Globally?

Let us come straight to the point. RAN shipments data recorded globally by several sources reveals the CAGR to be in single digits. Insight Research, on the other hand, pegs the growth for addressable market for AI in RAN in healthy double-digits. What explains the apparent dichotomy?

Well, the answer is very simple. There is no dichotomy here. Insight Research is not covering the market for the entire RAN, it is focused only on a high-growth niche driven by AI in the RAN. For AI applications covered by us, the base market size is low, the technology is new, the growth rate is bound to be higher. It is elementary really!

Even then, one would like to know, where is this growth coming from? Where are the real world examples of AI being used in the RAN?

Let us consider one major end-application of AI in RAN – Traffic optimization.

For markers of AI adoption in traffic optimization, look no further than 5G-SA implementations!

What SA implementations? Because, while SA may not alter the underlying radios, it definitely unleashes the newness in the NR and with it, 5G constructs such as ‘real’ network slicing.

And, 5G-SA is on a steady climb.

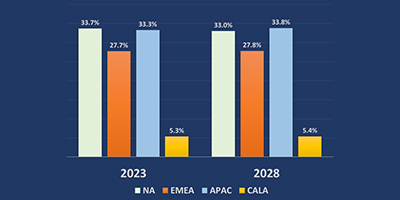

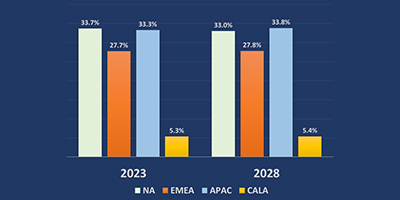

Let us now look at specific geographical regions.

The US market is presently witnessing an vigorous roll out of real 5G – the SA version with the NR technology. Given that the country itself is in the midst of a purple patch economically, in stark contrast with most of the developed world, it is not surprising that it is propelling the NA region into the leadership position for the market size. It also helps that US telcos such as AT&T are in many ways, the driving force behind the NFV movement. Verizon is also known to be testing network slicing aggressively. Given the profile of the market – having the appetite to consume and the deep pockets to pay for the investments in AI and ML driven superior network experience; North America was always going to be an emphatic early adopter.

The European market has witnessed some high profile network slicing trials on SA networks. These have been covered at length in the report. Being home to proactive telcos like Telefonica that have thought leadership traits, the EMEA region has been at the forefront of innovation throughout the journey of virtualization. The highly detailed and categorical AI and ML initiatives taken by Ericsson and Nokia, the largest global OEMs, gives the region a roundedness in terms of participation form the entire spectrum of telco stakeholders. It can be argued that Nokia and Ericsson have vested interest in being status quoist. They have however displayed remarkable agility in embracing concepts and technologies that will lay the foundation of the cellular mobile networks for the next few generations.

The APAC market is tailormade for the two principal use-cases – network slicing and edge computing. The region is densely populated, thereby making network slicing deployment more challenging. The full extent of network slicing in a densely populated region can only be imagined. The APAC also counts as the most industrialized region globally. The advent of Industry 4.0 is putting pressure on telcos to cater to extremes of throughput profile in a region with high levels of user density. As the telcos in the regions offer mobile data a unimaginably low tariffs, it has led to an explosion in data consumption, bringing into play the edge computing technology in a large way. Its sheer size and positive economic tailwinds will keep the APAC region squarely in the top spot.

Let us look at the CALA region. Technologically therefore there is little to separate in the telco attitude towards network slicing and edge computing. Matters take a different turn when the ARPU is not necessarily at the same level as the rest of the world. AI and ML are costly in terms of upfront and recurring expenses. Given the inconsistent state of finances in most the country markets, the enthusiasm for newer services has to be tempered with a dash of financial realities of the telcos.

All-in-all, this is where the AI in RAN market is coming from in terms of regional profiles.

|

RELATED BLOGS

What Drives AI in Network Optimization Globally?

What ails 5G-SA?